In this article we will tell you which company expenses should be considered general business expenses, and also determine in which account such expenses should be reflected and what transactions should be used in accounting.

What is considered general business expenses?

Account 26 in accounting is used to reflect general business expenses. Such expenses are expenses that cannot be attributed to the main production. However, without such expenses it is quite difficult to carry out the main activities of the company.

On accounting account 26 for dummies, reflect the following types of costs:

- Remuneration of the administrative personnel of the company (directorate, human resources department and accounting), as well as the amount of accrued insurance contributions to the payroll fund of the company administration.

- Depreciation of fixed assets and intangible assets that are used in the work of administrative personnel. For example, an office, computer equipment or accounting programs. Also repair of such OS.

- Payments for the rental of office space in which the company's administrative employees work.

- Inventories that are used in the work of the administration. For example, printed paper, stationery, fuel and lubricants for the director’s car.

- Information, consulting, legal services, as well as costs for the selection and retraining of workers, improving their qualifications. Security services, Internet services, telephone communications, periodic subscriptions and software.

- Other similar expenses.

Note that for some companies, accounting account 26 is used to reflect costs for the main activity. For example, brokerage houses. But trade organizations write off similar costs directly to special account 44 “Sales expenses”. Such features are subject to mandatory enshrinement in the accounting policies.

Typical transactions and accounting features

Account 26 is an active accounting account. That is, debit turnover increases OCR indicators, and credit turnover reflects the write-off of costs for main production. Closing the 26th account is mandatory at the end of the reporting period - month. That is, there should be no balances on this account at the end of the period.

Basic accounting entries:

How to close account 26

The method of closing account 26 depends on the method of generating product costs. The company must regulate such a choice in its accounting policies. Currently two methods are used:

- at actual cost;

- at reduced cost or direct costing method.

When writing off chemical and chemical works at actual cost, costs should be written off to accounting account 20 “Main production”. Note that if the company’s accounting includes auxiliary or servicing production workshops, then costs should also be distributed between 23 and 29 accounting accounts, respectively. However, OMR can be written off to these accounting accounts only if the company has performed such services or work for the benefit of third parties. The procedure for allocating costs and the method of distributing them between write-off accounts should be fixed in the accounting policy.

Accounting entry:

Dt 20 (23, 29) Kt 26.

To what account is account 26 closed using the direct costing method? If an organization operates at a reduced cost, then expenses for general business needs should be written off immediately to the account. 90-2 “Cost of sales”.

Accounting entry:

Dt 90-2 Kt 26.

Why is account 26 not closed?

When automating accounting, accountants quite often complain about problems with closing accounts for general business expenses. How to fix the error?

Depending on the type of specialized accounting program, in the accounting policy settings you should indicate the selected method for determining the cost of products, and also note the method of cost distribution.

If the settings are specified correctly, but closing is carried out with errors, check the analytical accounting for OCR. That is, control the reflection of transactions in terms of distribution by divisions of the enterprise and types of cost items. Apparently, in accounting there was a mis-grading in the analytical detailing of operations.

In this article, our specialists will reveal the secrets of using account 26, which is used in accounting. What are the main functions of this account? Are there any nuances in accounting methodology? How to correctly draw up standard postings for it? When can it be used in accounting practice?

Account 26: Basic Accounting Functions

In our country, accounting specialists use those accounts that are prescribed for use in a Chart of Accounts specially developed for these purposes. By the way, this document is standard, as it is approved at the government level by the country’s Ministry of Finance. In addition, it is necessary to use it in accounting if economic activity is carried out within the Russian Federation. True, this does not apply to government organizations that operate on a budgetary basis.

This Chart of Accounts is developed on the basis of a single instruction so that it is convenient for any accounting employee to use. It has its own clear structure - division into several thematic groups, each of which generalizes a certain type of economic activity.

Account 26 is called “General business expenses” because it serves to account not only for business expenses, but also for management ones, which are not directly related to the production activities of a company or individual entrepreneur. What exactly is meant by the term “general business expenses”? The compilers of the Chart of Accounts include:

- administrative and management costs;

- maintenance of workers engaged in general economic work, and not in production processes;

- depreciation charges, which should be used to fully restore fixed assets;

- repair of those fixed assets that have both general and administrative purposes;

- payment for the rental of premises intended to meet the needs of the general economy;

- payment for various types of services (for example, consulting, information, etc.);

- other costs of a similar type.

Thus, account 26 in the Chart of Accounts performs an accumulating function of collecting information on expenses that are directly related to management needs, and not the production process itself. In addition, the document is accompanied by instructions with detailed recommendations on how this account can be used and a list of all eligible expenses.

Methodological nuances of application

As already mentioned, in the Chart of Accounts there is a strict distribution into three classification groups:

- Active – are intended for keeping records of the company’s assets, do not have negative balance results (that is, there is no credit type).

- Passive - collects all data on the sources of financing assets, does not have a debit type balance.

- Active-passive - accumulate information about the productive activities of the company, as well as its debts to other companies (the balance can be of both types - credit and debit).

The expenses that the accountant is required to reflect on account 26 do not relate either to productive activities or to any sources of financing the company's assets. That is, according to the standard classification it should be classified as an active type. This can also be explained by the fact that the costs recorded on account 26 must be included in the cost of goods already produced (and these, as everyone knows, are the company’s assets).

Correct execution of standard transactions for account 26

Experts remind: every accounting operation aimed at economic activity is always reflected in several debit and credit accounts. This fixed reflection is called wiring. Therefore, each individual account has a number of transactions, which are the most common (that is why they are called typical or standard).

Our specialists have prepared two information tables that contain the main standard entries for account 26 of accounting.

Table No. 1 – “26 – debit”

| Accounting transaction name | credit |

|

- "02" |

|

- "05" |

|

- "10" |

|

- "21" |

|

- "23" |

|

- "29" |

|

- "43" |

|

— “60” |

|

- "68" |

|

- "69" |

|

- "70" |

|

- "71" |

|

- "76" |

|

- "94" |

|

- "96" |

|

- "97" |

Table No. 2 – “26 – credit”

| Accounting transaction name | debit |

|

- "08" |

|

- "20" |

|

- "23" |

|

- "28" |

|

- "29" |

|

- "76" |

|

- "86" |

|

- "90" |

|

- "97" |

|

- "99" |

Practical application of count 26

In accounting practice, this account can only be used to display general business expenses. Let's look at this with specific examples:

As you can see, in order to correctly arrange the wiring, you need to be able to clearly distinguish between general business needs and general production needs. These are completely different accounts (the second is 25). Their main difference is the functional features of each individual account. Experts give the following explanation:

- general housekeeping includes general expenses for any division or department of the company;

- general production involves expenses aimed specifically at meeting the needs of the company's production activities.

Cost accounts (20, 23, 25, 26) are closed in 1C automatically when performing the routine operation "".

However, this process often ends with errors. The main reason is incorrectly entered initial data. Let's see which data errors most often lead to errors in 1C 8.3 when closing accounts 20, 23, 25, 26.

First of all, let's understand what direct and indirect costs are. Why is it that cost account data is often not closed in 1C?

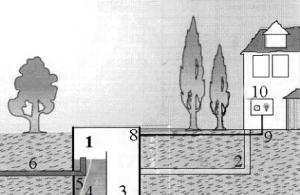

Figure 1 schematically shows direct costs, i.e. those that can be attributed to specific products. These costs are written off to 20 (main production) and 23 (auxiliary) accounts.

By “cost” we can understand the wages of production workers, the cost of consumables, depreciation of equipment, and other types of costs. The main thing that unites such costs is that the products to which they relate are known in advance.

Different colors indicate products and costs with the same analytics. In 1C - this (and, possibly, divisions, if their use is configured). In order for the cost to “get” to the desired product, it must have the same analytics.

Within a product group, costs are distributed in proportion to the planned cost.

“Cost 10” (Fig. 1) will “hang” in the department, since its analytics do not coincide with any products. This is the main reason for errors when closing 20 accounts.

In this case, in the program after the month is closed, the cost calculation will look like this (Fig. 2):

Get 267 video lessons on 1C for free:

As you can see, a line with zero cost appeared in the report, although there are both direct (“nuts”) and indirect costs (“labor”). There is no issue for this nomenclature group. To correct the error in closing account 20 in 1C Accounting, you need to check the costs for the “Footwear” item group.

For analysis, you can use the standard “Subconto Analysis” report (Fig. 3). Most likely, for the cost “Nuts” the “Main nomenclature group” should be selected, according to which “Nut butter” was produced.

Indirect costs on accounts 25 and 26

Let's look at indirect costs (Fig. 4). They apply to several types of products at once, so they require distribution. Such costs are taken into account in accounts 25 and 26. These may include storekeepers, dispatchers, accountants, the same (if the equipment is used to produce different types of products), etc.

Indirect costs are distributed among cost items in proportion to the distribution base. In Fig. 4, each cost item has its own color, and each product has a corresponding base (of the same color).

Necessary conditions for distribution:

- for each item a distribution method must be assigned;

- the corresponding base must be “attached” to the product.

For example, the item “Basic materials” is distributed in proportion to the planned cost. This means that this value must be indicated in the program for each product. In 1C, the planned cost is recorded in the document “Setting item prices”.

In Fig. 4, “purple” costs will not be distributed, since the base for them has not been determined. For example, the distribution method “Wages” was set for them, but in the current period there were no direct costs for the corresponding item.

Accounting account 26 is general business expenses or indirect costs, used in almost every enterprise, with the exception of state budgetary and credit organizations. In this article we will look at the main nuances of this account, its properties, typical transactions and examples of use in accounting.

Determination of general business expenses

General business expenses include all costs for administrative needs that are not directly related to production, provision of services or performance of work, but relate to the main type of activity.

The list of general business expenses depends on the profile of the organization and is not closed, according to the recommendations for using the chart of accounts.

The main general operating costs can be identified:

- Administrative and management expenses

- Business trips;

- Salaries of administration, accounting, management personnel, marketing, etc.;

- Entertainment expenses;

- Security, communication services;

- Consultations of third-party specialists (IT, auditors, etc.);

- Postal services and office.

- Repair and depreciation non-production fixed assets;

- Rent of non-industrial premises;

- Budget payments (taxes, fines, penalties);

- Others:

Organizations not related to production (dealers, agents, etc.) collect all costs on account 26 and subsequently write them off to the sales account (account 90).

Important! Trade organizations may not use account 26, but assign all expenses to account 44 “Sales expenses”.

Basic properties of 26 accounts

Let's consider the main properties of account 26 “General business expenses”:

- Refers to active accounts, therefore, it cannot have a negative result (credit balance);

- It is a transaction account and does not appear on the balance sheet. At the end of each reporting period it must be closed (there should be no balance at the end of the month);

- Analytical accounting is carried out according to cost items (budget items), place of origin (divisions) and other characteristics.

Typical wiring

Account 26 “General business expenses” corresponds with the following accounts:

Table 1. By debit of account 26:

| Dt | CT | Wiring Description |

| 26 | 02 | Depreciation calculation for non-production fixed assets |

| 26 | 05 | Depreciation calculation for non-production intangible assets |

| 26 | 10 | Write-off of materials, inventory, workwear for general business needs |

| 26 | 16 | Variance in the cost of written-off general business materials |

| 26 | 21 | Write-off of semi-finished products for general business purposes |

| 26 | 20 | Attribution of costs (work, services) of the main production to general economic needs |

| 26 | 23 | Attribution of costs (work, services) of auxiliary production to general economic needs |

| 26 | 29 | Attribution of costs (work, services) of service production to general economic needs |

| 26 | 43 | Write-off of finished products for general business purposes (experiments, research, analyses) |

| 26 | 50 | Decommissioning of postage stamps |

| 26 | 55 | Payment of expenses (minor work, services) from special bank accounts |

| 26 | 60 | Payment for work and services of third parties for general business needs |

| 26 | 68 | Calculation of payments of taxes, fees, penalties |

| 26 | 69 | Deduction for social needs |

| 26 | 70 | Calculation of wages for administrative, managerial and general business personnel |

| 26 | 71 | Accrual of travel expenses, as well as accountable expenses for small general business needs |

| 26 | 76 | General expenses related to other creditors |

| 26 | 79 | General business expenses associated with the organization's divisions on a separate balance sheet |

| 26 | 94 | Write-off of shortages without persons at fault, except for natural disasters |

| 26 | 96 | Assigning general business expenses to the reserve for future expenses and payments |

| 26 | 97 | Write-off of a share of future expenses for general business expenses |

Table 2. For the credit of account 26:

| Dt | CT | Wiring Description |

| 08 | 26 | Attribution of general business expenses to capital construction |

| 10 | 26 | Capitalization of returnable waste and unused materials written off as general business expenses |

| Write-off of general business expenses at the end of the month, that is, where the 26th invoice is written off | ||

| 20 | 26 | For main production |

| 21 | 26 | For the production of semi-finished products |

| 29 | 26 | For service production |

| 90.02 | 26 | Performed work and services for third parties |

| 90.08 | 26 | On the cost of sales when using the direct costing method |

Closing 26 accounts

Closing account 26, that is, writing off all general business expenses, is performed in several ways:

- Included in the cost of production through production accounts if products are produced;

- Referred to as cost of sales when providing services or work;

- Referred to the current expenses of the reporting month using the direct costing method:

Important! The write-off method, as well as the basis for the distribution of general business expenses, must be fixed in the accounting policies of the organization.

Write-off as part of the cost of production

In this case, general business expenses are written off in shares, taking into account the distribution base, into production accounts and may remain on product cost accounts (for example, when producing products under account 43 “Finished Products”) or production accounts (for example, work in progress under account 20 “Main Production” ) at the end of the reporting period.

Main types of cost distribution bases:

Get 267 video lessons on 1C for free:

- Revenue

- Product output volume

- Planned cost of production

- Material costs

- Direct costs

- Salary and so on

When closing the month, the following transactions are generated, for example:

General business expenses are distributed to the cost of production (production accounts) according to the specified distribution and analytical accounting base:

Therefore, general business expenses are written off:

- In full - if one product is produced (no analytics);

- Distributed across all types of products in proportion to the selected base - if several types of products are produced and calculated in the context of analytics.

Example

LLC "Horns and Hooves" produces hats and shoes, the production of which is carried out at a planned cost. In an organization, direct expenses are reflected in account 20 “Main production”, and indirect expenses in account 26 “General business expenses”.

- The distribution base is material costs.

In November 2016, direct expenses amounted to RUB 51,040.00:

- For headwear – RUB 28,020.00. of them:

- Material costs – RUB 15,000.00.

- For the production of shoes - RUB 23,020.00. of them:

- Material costs – RUB 10,000.00.

indirect costs – 18,020 rubles.

- 3/p administrative staff – RUB 10,000.00.

- Insurance premiums – RUB 3,020.00.

- Premises rental – RUB 5,000.00.

According to the distribution base for material costs:

Postings when closing account 26

Important! Also in the accounting policy, you can indicate non-distributable general business expenses, which will be written off immediately to current expenses in Account 90.08.

Write-off to cost of sales

If the accounting policy specifies the write-off method “to cost of sales,” then the following transactions are taken into account when closing the period:

In this case, costs can also be taken into account in terms of analytics.

Write-off using direct costing method

If the accounting policy specifies the “direct costing” write-off method, then general business expenses are taken into account as semi-fixed and when closing the period they are reflected in the following entries:

| Dt | CT | Wiring Description |

| 90.08 | 26 | General business expenses are written off as cost of sales |

In this case, the amount of costs is written off in full in each reporting period.

Examples of using account 26 “General business expenses”

Let's look at the above postings using examples.

Example 1. Closing an account for the cost of production at the planned cost, one type of product

LLC "Horns and Hooves" produces products, the production of which is carried out at a planned cost. In an organization, direct expenses are reflected in account 20 “Main production”, and indirect expenses in account 26 “General business expenses”.

The accounting policy states:

- General business expenses are written off against the cost of production.

- The distribution base is the planned cost.

- 3/p production employees – RUB 20,000.00.

- Insurance premiums – RUB 6,040.00.

| date | Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| Output | |||||

| 16.11.2016 | 43 | 40 | 85 000 | ||

| 16.11.2016 | 20 | 10 | 62 000 | Write-off of materials | Request-invoice |

| 30.11.2016 | 20 | 70 | 20 000 | Salary accrued | |

| 30.11.2016 | 70 | 68 | 2 600 | Personal income tax withheld | |

| 30.11.2016 | 20 | 69 | 6 040 | Insurance premiums accrued | |

| 30.11.2016 | 26 | 70 | 10 000 | Salary accrued | Time sheet, payslip |

| 30.11.2016 | 70 | 68 | 1 300 | Personal income tax withheld | |

| 30.11.2016 | 26 | 69 | 3 020 | Insurance premiums accrued | |

| Closing the month | |||||

| 30.11.2016 | 20 | 26 | 10 000 | ||

| 30.11.2016 | 20 | 26 | 3 020 | ||

| 30.11.2016 | 40 | 20 | 101 060 | ||

| 30.11.2016 | 43 | 40 | 16 060 | ||

Important! If PBU is used, and general business expenses are taken into account in tax accounting as indirect expenses (established in the accounting policy), then temporary differences (TD) also arise:

| VR/NU | Account Dt | Kt account | Amount, rub. | Wiring Description |

| VR | 20 | 26 | 10 000 | Closing account 26 (salaries) |

| WELL | 90.08 | 26 | 10 000 | |

| VR | 90.08 | 26 | -10 000 | |

| VR | 20 | 26 | 3 020 | Closing account 26 (insurance premiums) |

| WELL | 90.08 | 26 | 3 020 | |

| VR | 90.08 | 26 | -3 020 | |

| WELL | 40 | 20 | 88 040 | Write-off of the actual cost of production |

| VR | 40 | 20 | 13 020 | |

| WELL | 43 | 40 | 3 040 | Adjustment of product cost to actual value |

| VR | 43 | 40 | 13 020 |

Example 2. Closing an account for the cost of sales when providing services

Horns and Hooves LLC provides security services. General business expenses are written off immediately to the cost of security services.

In November 2016, general business expenses amounted to RUB 23,020.

- 3/p personnel – RUB 10,000.00;

- Insurance premiums – RUB 3,020.00;

- Premises rental – RUB 10,000.00:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| 24.11.2016 | 26 | 60 | 10 000 | Rent accrued | The act of providing services |

| 26.11.2016 | 62 | 90.01 | 30 000 | Revenue accounting | The act of providing services |

| 90.03 | 68 | 5 400 | VAT charged | ||

| 30.11.2016 | 26 | 70 | 10 000 | Salary accrued | Time sheet, payslip |

| 30.11.2016 | 70 | 68 | 1 300 | Personal income tax withheld | |

| 30.11.2016 | 26 | 69 | 3 020 | Insurance premiums accrued | |

| Closing the month | |||||

| 30.11.2016 | 90.02 | 26 | 23 020 | Write-off of general business expenses to cost of sales posting | |

Example 3. Closing an account using the direct costing method

LLC "Horns and Hooves" produces products. In an organization, direct expenses are reflected in account 20 “Main production”, and indirect expenses in account 26 “General business expenses”.

The accounting policy states:

- General business expenses are written off using the direct costing method.

In November 2016, direct expenses amounted to RUB 88,040:

- 3/p production employees – RUB 20,000.00;

- Insurance premiums – 6,040.00 rubles;

- Material costs – RUB 62,000.00.

Indirect costs – RUB 13,020:

- 3/p administrative personnel – 10,000.00 rubles;

- Insurance premiums – RUB 3,020.00:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| Output | |||||

| 16.11.2016 | 43 | 40 | 85 000 | Release of finished products (at planned cost) | Production report, invoice on acceptance of products to the warehouse |

| 16.11.2016 | 20 | 10 | 62 000 | Write-off of materials | Request-invoice |

| Payroll for production workers | |||||

| 30.11.2016 | 20 | 70 | 20 000 | Salary accrued | Time sheet, payslip |

| 30.11.2016 | 70 | 68 | 2 600 | Personal income tax withheld | |

| 30.11.2016 | 20 | 69 | 6 040 | Insurance premiums accrued | |

| Payroll for administrative and management personnel | |||||

| 30.11.2016 | 26 | 70 | 10 000 | Salary accrued | Time sheet, payslip |

| 30.11.2016 | 70 | 68 | 1 300 | Personal income tax withheld | |

| 30.11.2016 | 26 | 69 | 3 020 | Insurance premiums accrued | |

| Closing the month | |||||

| 30.11.2016 | 90.08 | 26 | 10 000 | Closing account 26 (salaries) | |

| 30.11.2016 | 90.08 | 26 | 3 020 | Closing account 26 (insurance premiums) | |

| 30.11.2016 | 40 | 20 | 88 040 | Write-off of the actual cost of production (26,040.00 (Labor) + 62,000.00 (Material costs) + 13,020.00 (General expenses)) | |

| 30.11.2016 | 43 | 40 | 3 040 | Adjustment of product cost to actual value | |

", November 2017

Both beginners and experienced users have questions about closing 20, 23, 25, 26 accounts. Using the example of the program “1C: Enterprise Accounting 8”, ed. 3.0, let’s look at what settings need to be made so that cost accounts are closed correctly every month.

Setting up accounting policies

The organization's accounting policy is created in the program annually, and reference books are filled out along with it: methods for determining indirect costs and a list of direct costs.

The screenshot shows that it is possible to check two boxes:

« Output" - should be owned by those organizations engaged in production.

« Carrying out work and providing services to customers» – should be used by organizations that specialize in providing production services.

If none of these settings are selected, then it is understood that the program is run by a trading organization - “bought and sold” - nothing will be produced and no services will be provided, therefore, the account will not be used at all in the activities of such an organization.

Recommendations for correcting errors that occur when closing a month

A very common situation is that the closing of the month was successful, the program did not produce any errors, but when generating the balance sheet, the user notices that on January 20 the account was closed to the account on August 90 or was not closed at all. You need to do the following:

look at the entries in the routine operation “Closing accounts: 20, 23, 25, 26” to which account the account was closed /. If it closed on August 90, then you need to check the list of direct expenses; perhaps there are not enough entries here;

according to the report “Analysis of sub-conto: item group, analyze for which item group and cost item the account was not fully/partially closed / to account 90.02. If the direct expense accounts are not closed at the cost of production, this may mean that there is work in progress in the program, there are not enough entries in the list of direct expenses, or there is no revenue for this item group.

After checking the documents and making changes to them, you must close the month again.

It also happens that the program produces errors indicating where the problem is and what needs to be done to correct these errors. Everything is simple here, you should read all the information that the program provided, correct errors following the recommendations, and close the month again.

In conclusion, let us once again draw attention to the fact that the organization’s accounting policy is created annually, and along with it, methods for distributing indirect costs and a list of direct costs are created. The list of direct expenses is key, precisely due to the presence of entries in it, the program “1C: Accounting 8”, ed. 3.0, determines what to write off as indirect expenses when closing the month, and what to direct expenses.