There are several ways to reverse an erroneous amount.

With retro discounts, the reversal occurs for the seller, but not for the buyer.

Reverse postings distort account turnover.

Errors in accounting records can have tax consequences. To avoid this, it is important for the company to detect possible distortions in time and correct them.

One of the adjustment methods is the “red reversal”. This method of making corrections is used if incorrect correspondence of accounts is given in the accounting. The point is that the erroneous wiring is first repeated in red ink (or in red in a computer program). When calculating the totals in the registers, the amounts written in red ink are subtracted from the total. Thus, the incorrect entry is canceled. After this, a new entry is made with the correct account correspondence or the correct amount.

Reflecting reverse postings instead of reversing an inflated amount entails a doubling of account turnover

Often errors occur due to the accountant's carelessness or a glitch in the accounting program. For example, the organization received a certificate of completion of work in the amount of 30,000 rubles. And the accountant made the following entry by mistake:

Debit 44 Credit 60 - 33,000 rub.

In this case, you can reverse the difference between the correct and incorrect amount:

Debit 44 Credit 60 - -3000 rub.

Or reverse the entire erroneous amount and reflect the correct entry:

Debit 44 Credit 60 - -33,000 rub.;

Debit 44 Credit 60 - 30,000 rub.

In both cases, there will be no accounting distortions. But if the accountant does not keep analytical records, it will be easier for him to remember the reason for the correction if the entire amount of transactions is reflected in the accounting, and not just the difference.

In addition, to make corrections, you can use reverse entries - the amount previously recorded on the debit side of the account is indicated on the credit side of this account and vice versa:

Debit 44 Credit 60

- 33,000 rub. - the incorrect transaction amount is reflected;

Debit 60 Credit 44

- 3000 rub. - the amount has been corrected.

The final account balances will be correct, but the turnover will double. Therefore, we do not recommend using this correction procedure.

Let us remind you that in any case, when making corrections, you must draw up an accounting certificate in which you indicate the error and justify its correction. The form of the certificate is not unified, but it makes sense to reflect all the mandatory details of the primary document, as well as the information necessary to determine the reasons for the correction: details of payment documents, contracts, settlements (Part 2 of Article 9 of Law No. 402-FZ).

It is impossible to correct mistakes of past years through reversal, if last year's reporting has already been approved

If an accountant has identified an error that was made last year, then the possibility of using the “red reversal” method depends on whether the reporting for last year has been approved or not yet (clauses 5 - 14 of PBU 22/2010).

Corrections are not made to the approved reporting, therefore it is impossible to reverse the data in accounting for the previous year (clause 10 of PBU 22/2010). The accountant will correct the erroneously inflated amount of the transaction on the date of discovery of the error with the recognition of profits or losses of previous years or in the accounts of other income or expenses (clauses 9 and 14 of PBU 22/2010).

Note. Errors from previous years cannot be corrected using reversal entries.

Example 1. Let's use the data from the example discussed above.

November 25, 2013

Debit 44 Credit 60

- 33,000 rub. - an error was made in the amount of expenses;

August 15, 2014

Debit 60 Credit 91

- 3000 rub. - other income is reflected in the amount of expenses incorrectly taken into account last year (the error is assessed by the company as insignificant);

August 15, 2014

Debit 60 Credit 84

- 3000 rub. - retained earnings increased (the error was assessed by the company as significant).

Let us remind you that this procedure does not apply in tax accounting. An identified error from last year is corrected in the tax period in which it was made, regardless of the time it was discovered. If expenses were inflated, then an income tax arrears arose. Therefore, it is necessary to submit an updated declaration for this tax (clause 1 of Article 81 of the Tax Code of the Russian Federation).

If VAT was also deducted in a larger amount on the inflated amount of expenses, then an updated VAT return will also have to be submitted.

Note. "Red reversal" does not always mean correcting errors.

Reference. Methods for correcting data in accounting documents

Correction of accounting errors is regulated by Federal Law dated December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Law N 402-FZ) and the Accounting Regulations “Correcting Errors in Accounting and Reporting” (PBU 22/2010).

In order to correct errors, accountants, in addition to the “red reversal” method, have several other methods:

- proofreading method. Used to correct errors in primary documents and accounting registers. The incorrect word or amount is crossed out with a thin line so that the original version can be read, and the correct value is carefully written on top. The correction is certified by the signature of the person responsible for maintaining the register, the date and seal of the organization is affixed (Part 7, Article 9 and Part 8, Article 10 of Law N 402-FZ, Section 4 of the Regulations on Documents and Document Flow in Accounting, approved by the Ministry of Finance USSR 07/29/1983 N 105, and Letter of the Ministry of Finance of Russia dated 03/31/2009 N 03-07-14/38). Thus, corrections to the accounting registers are made before the totals are calculated. This method is used for “manual” accounting, without the use of computer programs;

- method of additional wiring. It is used when the transaction was not reflected in a timely manner or, with correct correspondence of accounts, the transaction amount turned out to be less than the real one. In this case, an additional accounting entry is made for the amount of the transaction or for the difference between the correct and reflected amounts. At the same time, an accounting certificate is drawn up, which explains the reasons for the correction. Thus, errors identified both in the current and in previous periods are corrected.

Providing retrospective discounts entails reversal of revenue for the seller, the buyer does not change the price of goods

Accountants have to reverse previously carried out transactions not only in case of mistakes, but also when providing discounts based on the results of shipments for the past period. That is, after the seller ships the goods and records the revenue, and the buyer accepts these goods for accounting. At the end of the period, the seller provides a discount on already shipped inventory items (for example, for large volumes of purchases).

According to the accounting rules, revenue is recognized based on all discounts and markups provided to customers (clauses 6 and 6.5 of PBU 9/99 “Organizational Income”, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n).

Example 2. The seller shipped the first batch of goods to the buyer in the amount of 11,800 rubles, including VAT - 1,800 rubles.

Then, within a month, the second batch for 23,600 rubles, including VAT - 3,600 rubles.

At the end of the month, the seller provided a 10% discount on shipped goods:

11,800 rub. + 23,600 rub. = 35,400 rub.;

RUB 35,400 x 10% = 3540 rubles, including VAT - 540 rubles.

The seller makes the following accounting entries:

July 15, 2014

Debit 62 Credit 90

- 11,800 rub. - revenue from sales is reflected;

Debit 90 Credit 68

- 1800 rub. - VAT is charged on sales proceeds;

July 25, 2014

Debit 62 Credit 90

- 23,600 rub. - revenue from sales is reflected;

Debit 90 Credit 68

- 3600 rub. - VAT is charged on sales proceeds.

Debit 62 Credit 90

- -3540 rub. - previously recorded revenue was reversed by the amount of the discount;

Debit 90 Credit 68

- -540 rub. - VAT on revenue has been reduced after issuing an adjustment invoice.

When receiving a retrospective discount, the buyer cannot adjust the cost of capitalized goods (clause 12 of PBU 5/01 “Accounting for inventories, approved by Order of the Ministry of Finance of Russia dated 06/09/2001 N 44n). Therefore, he will reflect the discount as other income, even if it received in the same year as the goods were registered:

July 15, 2014

Debit 41 Credit 60

- 10,000 rub. - purchased goods are reflected;

Debit 19 Credit 60

- 1800 rub. - VAT is reflected on the cost of goods;

Debit 68 Credit 19

- 1800 rub. - subject to deduction of VAT from the cost of goods;

July 25, 2014

Debit 41 Credit 60

- 20,000 rub. - purchased goods are reflected;

Debit 19 Credit 60

- 3600 rub. - VAT is reflected on the cost of goods;

Debit 68 Credit 19

- 3600 rub. - subject to deduction of VAT from the cost of goods.

On August 4, the buyer was given a 10% discount on shipped goods (RUB 3,540):

Debit 60 Credit 91

- 3000 rub. - other income is reflected in the amount of the discount received from the seller.

After receiving a document from the seller about granting a discount or receiving an adjustment invoice, the buyer needs to restore VAT from the cost of goods accepted for deduction:

Debit 19 Credit 60

- 540 rub. - VAT is reflected on the discount amount.

At the same time, the seller reflects the provision of discounts on goods shipped last year in accounting without using reversal entries, but posts them to account 91 “Other income and expenses” (Chart of accounts and Instructions for its use, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

Reversal entries are reflected when returning goods in the same year as the sale

Proceeds from the sale of goods are reflected in the seller’s accounting at the moment of transfer of ownership to the buyer (clause 12 of PBU 9/99). The buyer's right of ownership arises from the moment the goods are transferred to him by the seller - delivery of the goods to the buyer or the carrier (Articles 223 and 224 of the Civil Code of the Russian Federation).

If the buyer returns part of the goods to the seller, this means that ownership has not transferred. Therefore, the seller has no reason to take into account the proceeds from the sale of these goods - he makes accounting adjustments.

Note. When the buyer returns goods or provides a retro discount, the seller reverses the proceeds.

In the event of a detected defect, the buyer draws up a report on the established discrepancy in quantity and quality upon acceptance of inventory items, which is the legal basis for filing a claim with the seller. And based on the claim made by the buyer, the seller’s records appear in red ink.

Example 3. On April 25, 2014, LLC "Company 1" shipped LLC "Company 2" freezers in the amount of 3 pieces at a price of 24,780 rubles. per piece (including VAT - 3,780 rubles).

The cost of one camera is 17,000 rubles.

On May 6, 2014, Company 2 LLC sends Company 1 LLC a claim that one of the supplied cameras was defective and returns it.

On the same day, the seller transfers funds for the returned products.

In accounting, the seller makes the following entries:

April 25, 2014

Debit 62 Credit 90

- 74,340 rub. - revenue for sold products is reflected;

Debit 90 Credit 68

- 11,340 rub. - VAT is calculated based on the invoice;

Debit 90 Credit 43

- 51,000 rub. - the cost of goods sold is written off;

May 6, 2014

Debit 62 Credit 90

- -24,780 rub. - previously recorded revenue was reversed;

Debit 90 Credit 43

- -17,000 rub. - the previously written-off cost of sold defective products was adjusted;

Debit 90 Credit 99

206

- -4000 rub. - previously reflected profit from the sale of defective products was adjusted;

Debit 90 Credit 68

- -3780 rub. - claimed VAT deduction on returned products;

Debit 43, 28 Credit 43

- 17,000 rub. - acceptance of products returned by the buyer to the warehouse on the basis of an act;

Debit 62 Credit 51

- 24,780 rub. - money returned for defective products.

Note. When is the red reversal method still used?

Organizations prescribe in their accounting policies how they keep track of finished products - according to the actual cost in account 43 “Finished Products” or according to the standard cost, when along with account 43 account 40 “Output of Finished Products” is used. Count 40 is used in small industries and with a small range of products.

At the end of each month, the organization compares the balance of account 40 by debit and credit. The deviation shows the difference between the actual cost and the planned cost. The excess of the standard cost over the actual cost (savings) is reversed to the credit of account 40 and the debit of account 90 “Sales”. Overexpenditure - the excess of actual cost over standard cost - is written off from the credit of account 40 to the debit of account 90 “Sales” by an additional entry.

In addition, “red reversal” entries are constantly found in the accounting of retail trade organizations that keep records at sales prices. Such organizations form the selling price of goods based on the price at which they purchased goods from suppliers and the trade margin.

The amounts of trade margins (discounts, markups) on goods sold, released or written off due to natural loss, defects, damage, shortages are reversed by the seller to the credit of account 42 “Trade margin” in correspondence with the debit of account 90 “Sales”.

Read on e.rnk.ru. The procedure for tax accounting of buyer discounts and other measures to increase sales

What is the position of departments and courts on the issue of accounting for the costs of displaying goods on the sales floor, sending advertising SMS messages, holding promotions and distributing product samples? Is the provision of goods in exchange for accumulated points considered a gratuitous transfer for income tax purposes?

Read the answers to these questions, as well as about other complex aspects of taxation of discounts on the website e.rnk.ru in the articles “Nuances of accounting for costs of stimulating potential and existing customers” // RNA, 2014, No. 7 and “Retrospective discounts have become safer in compared with the payment of premiums and bonuses to customers" // RNA, 2012, No. 9.

If the goods are returned in the year following the sale, then the seller does not need to reverse the proceeds. In this case, as part of other expenses, it will reflect the loss of previous years identified in the current year (clause 11 of PBU 10/99 “Expenses of the organization,” approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n).

The one who does nothing makes no mistakes. This truth is known to every accountant who has found accounting errors in a closed period. Reversal in 1C 8.3 Accounting is a way to correct such errors. Read how to make a reversal in 1C 8.3 in this article.

The accounting word “reversal” comes from the Italian “stornate” - to turn back. In posting language, this means creating accounting entries with a minus sign. Reversal in 1C is used in the following cases:

- corrections of errors in accounting;

- write-offs of realized trade mark-ups in retail trade;

- adjustments to the value of material assets;

- adjustments to valuation allowances.

In this article, you will learn how to correct accounting errors by reversing entries. For example, how to reverse a receipt from a previous period in 1C 8.3. Also here you will read how to reverse an implementation in 1C 8.3. Read on to learn how to make a reversal in 1C 8.3 in four steps.

Step 1. Create a “reversal of document” operation in 1C 8.3

Go to the “Operations” section (1) and click on the “Manually entered operations” link (2). A window will open for creating a “reversal of document” operation.In the window that opens, click the “Create” button (3) and click on the “Document Reversal” link (4). A form will open for filling out the “cancel document” operation.

In the window that opens, in the “Organization” field (5) indicate your organization, in the “Date” field (6) - the date of the operation.

In the window that opens, in the “Organization” field (5) indicate your organization, in the “Date” field (6) - the date of the operation.  Next, you can begin reversing various transactions. For example, to reverse a transaction for the receipt of goods (services).

Next, you can begin reversing various transactions. For example, to reverse a transaction for the receipt of goods (services).

Step 2. Perform an operation to reverse the receipt of the previous period

In the “Document Reversal” form there is a “Document Reversal” field (1). In this field on the right, click on the selection button “...”. A list of documents and transactions will open (2). To reverse a receipt from a previous period, select “Receipt (act, invoice)” (3) from this list. A window will open with a list of previously created receipt documents. In the window that opens, select the receipt invoice (4) that you want to cancel and click the “Select” button (5).

In the window that opens, select the receipt invoice (4) that you want to cancel and click the “Select” button (5).  After this, the “Accounting and tax accounting” (6) and “VAT presented” (7) tabs will appear at the bottom of the window. In the “Accounting and Tax Accounting” tab, you can see the entries (8) that were made in the erroneous document. The amounts in these transactions (9) are indicated with a minus sign.

After this, the “Accounting and tax accounting” (6) and “VAT presented” (7) tabs will appear at the bottom of the window. In the “Accounting and Tax Accounting” tab, you can see the entries (8) that were made in the erroneous document. The amounts in these transactions (9) are indicated with a minus sign.  In the “VAT presented” tab you can see the reversing entry for VAT registers (10).

In the “VAT presented” tab you can see the reversing entry for VAT registers (10).  Thus, the operation “Reversal of document” cancels entries in accounting and tax accounting for the selected receipt document. Entries in special 1C registers are also canceled.

Thus, the operation “Reversal of document” cancels entries in accounting and tax accounting for the selected receipt document. Entries in special 1C registers are also canceled. To complete the operation to reverse the receipt, click the “Record” button (11). Now reversing entries are reflected in accounting 1C 8.3 Accounting. In order to print an accounting certificate for a reversing transaction, click the “Accounting certificate” button (12). A printable help form will open.

In the printed help form, click the “Print” button (13).

In the printed help form, click the “Print” button (13).

Step 3. Reverse the implementation in 1C 8.3

Create a reversal transaction as in step 1 of this article. In the “Document to be canceled” (1) field, select “Sales (deed, invoice)” (2). A window will open with a list of previously created implementations. From the list, select the sale you want to reverse (3). The “Accounting and Tax Accounting” and “VAT Sales” tabs with reversing entries will appear at the bottom of the window.

From the list, select the sale you want to reverse (3). The “Accounting and Tax Accounting” and “VAT Sales” tabs with reversing entries will appear at the bottom of the window.  In the “Accounting and Tax Accounting” tab, you can see the entries (4) that were made in the erroneous document. The amounts in these transactions (5) are indicated with a minus sign.

In the “Accounting and Tax Accounting” tab, you can see the entries (4) that were made in the erroneous document. The amounts in these transactions (5) are indicated with a minus sign.  In the “VAT Sales” tab (6) you can see the reversing entry for VAT registers (7).

In the “VAT Sales” tab (6) you can see the reversing entry for VAT registers (7).  To complete the operation of reversing the sale, click the “Write” button (8). Now reversing entries are reflected in 1C 8.3 Accounting. Read how to print an accounting certificate in step 2 of this article.

To complete the operation of reversing the sale, click the “Write” button (8). Now reversing entries are reflected in 1C 8.3 Accounting. Read how to print an accounting certificate in step 2 of this article.

Step 4. Don’t forget to submit updated tax returns after correcting errors in the closed period

If you reversed data from a previous tax period, you will need to submit corrective tax returns. We remind you that tax clarifications are submitted for the period in which erroneous entries were made.Every accountant has probably encountered such a problem that they need to delete an erroneous document in the previous period. But the period has already closed, the reporting has been submitted.

For such cases, 1C 8.3 (as well as 1C 8.2) provides for a reversal operation. It lies in the fact that in the current period all the same movements of the previous document are repeated in all accounting registers (accounting, tax, etc.), but with the opposite sign.

I will demonstrate how to reverse a document in 1C using an example.

How to make a reversal in 1C according to a document

In the 1C 8.3 program: “Enterprise Accounting 3.0” (and in some others where there is an accounting module) there is a document ““. Let's create it.

Where is the reversal in 1C? Go to the “Operations” menu, then in the “Accounting” section click on the link “Operations entered manually”. A window with a list of documents will open. Click the “Create” button and select “Document Reversal” from the drop-down menu:

A form for creating a new document will open. Select the organization and the document to be reversed. First, a list of all documents that are in the program will appear. We select the one we need from it. I propose to reverse the document for the sale of goods issued erroneously in the first quarter:

After selecting the document type, a list of all documents for the established organization will appear. Let's choose any one. The tabular part of the reversal document will be filled in automatically:

Get 267 video lessons on 1C for free:

As you can see, all amounts and quantities have a negative sign. In the register for accounting for VAT on sales, VAT on this sale was also reversed:

Reversal can only be done using one document. Document data is available for editing.

To print the accounting certificate, you can use the “Print” button:

Reversal of an arbitrary register in 1C

Some documents in 1C 8.3 make entries in . A good example is the document ““. If we watch his movements, we will see the following:

When reversing such a document, the information registers also need to be adjusted.

Please tell me, in the 4th quarter of 2014, the sale of goods was carried out by mistake. Noticed in the 1st quarter. How to correctly reflect a reversal in accounting and tax accounting, how to deduct VAT, what kind of invoice to issue and where to register it

IN In your situation, the error from 2014 (the previous reporting year) was identified in the 1st quarter of 2015, i.e. after approval of the financial statements for 2014. In this case, make corrections to the accounting in the period in which the error was identified, that is, in the 1st quarter.

Errors are divided into significant and insignificant. Your organization determines the materiality threshold independently, in accordance with its accounting policies.

If significant errors are identified from previous years, make corrections using account 84. If the error is insignificant, then use account 91.

In this case, your organization has the right, but is not obligated, to make the necessary changes to the profit tax return and submit to the tax authority an updated tax return for the reporting period in which the error was made. Also, the results of recalculation (reduction) of the tax base due to errors made in past periods can be recorded in declarations for current periods.

You need to issue a corrected invoice.

If errors are discovered, the organization must make corrections to the sales book. And to do this, it is necessary to draw up an additional sheet to the sales book for the period in which the error was made. Thus, an error made when determining the tax base for VAT in the past period can be corrected in the only way - by submitting an updated tax return for this period.

The rationale for this position is given below in the materials of the Glavbukh System

For example, you can write down the materiality threshold as follows: “An error is considered significant if the ratio of its amount to the balance sheet currency for the reporting year is at least 5 percent.”

Error correction

Identified errors and their consequences must be corrected (clause 4 of PBU 22/2010).

Make accounting corrections based on primary documents. Also draw up accounting certificates, indicating the rationale for the corrections. This follows from the general rule that each fact of economic activity must be documented in a primary accounting document. This is directly stated in Part 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ.*

Having determined the significance of the error and taking into account the moment when it was discovered, make corrections in the accounting. How exactly – the table below will help you with this.

| When and what error was discovered? | How to fix | Base |

| A significant error was identified in subsequent years. Reporting for the period when the error occurred was prepared, signed by the manager, presented to external users and approved | Make corrections in the period in which the error was identified. There is no need to update the reporting for the period in which the error was made. All changes related to previous periods should be reflected in the reporting of the current period. In the explanations to the annual reporting of the current period, indicate the nature of the corrected error, as well as the amount of adjustments for each item |

Clause 39 of the Regulations on accounting and reporting and paragraphs and PBU 22/2010 |

| A minor error was identified for any prior year |

Make adjustments in the period in which the error was identified There is no need to submit information about corrections of immaterial errors from previous periods in current reporting. Making changes to submitted reports is also |

Clause 14 PBU 22/2010* |

Accounting

The postings used to make corrections depend on the moment when the error is discovered and how significant it is. Accounting entries will differ in the following cases:*

- correct errors of the current period;

- mistakes of past periods rule - significant and insignificant.*

How to correct significant errors from previous periods in accounting

Correct significant errors from last year that were discovered before the approval of the annual reports for that period using the appropriate accounts of costs, income, calculations, etc.

If significant errors are identified from previous years, the reporting for which has been signed and approved, make corrections using account 84 “Retained earnings (uncovered loss)” (subclause 1, clause 9 of PBU 22/2010).*

Option 2. If, as a result of an error, the accountant did not reflect any expense or overstated income, make the following entry:

Debit 84 Credit 60 (76, 02...)

– an erroneously unrecorded expense (overrecorded income) from the previous year was identified.*

An example of correcting a minor error (not reflected expense) in accounting and tax accounting. A mistake was made last year, the reporting for which was signed and approved. In tax accounting, an error is corrected in the period in which it was made*

In March 2014, the accountant of Alfa CJSC discovered an error when calculating income tax for 2013 - expenses (cost of goods sold) in the amount of 150,000 rubles were not taken into account. Expenses are recognized equally in tax and accounting. As a result, the organization overpaid the tax; the amount of the overpayment amounted to 30,000 rubles. (RUB 150,000 ? 20%).

Alpha's accountant filed an updated income tax return for 2013 and made the following entries:

Debit 91 subaccount “Other expenses” Credit 41

– 150,000 rub. – expenses (cost of goods sold) of the previous tax period identified in the reporting year are reflected;

Debit 68 subaccount “Calculations for income tax” Credit 99 subaccount “Overpayment of income tax according to an updated declaration”

– 30,000 rub. – the income tax of the previous year was reduced according to the updated declaration;

Debit 99 subaccount “Fixed tax liabilities” Credit 68 subaccount “Calculations for income tax”

– 30,000 rub. – a permanent tax liability is reflected for the amount of expenses of 2013, which is shown in accounting in expenses of 2014, and in tax accounting - in expenses of 2013.

For the first quarter of 2014, the amount of tax payable to the budget is 110,000 rubles. The balance sheet profit is less than the tax profit due to expenses taken into account for taxation in the updated declaration of the previous year. The tax calculated on balance sheet profit is RUB 80,000. (RUB 110,000 – RUB 30,000). The accountant makes the following entry:

Debit 99 subaccount “Conditional income tax expense” Credit 68 subaccount “Calculations for income tax”

– 80,000 rub. – reflects the conditional income tax expense.

Taking into account the overpayment of tax for 2013, 80,000 rubles must be transferred to the budget. (RUB 110,000 – RUB 30,000).

Elena Popova, State Advisor to the Tax Service of the Russian Federation, 1st rank

Overpayment of taxes

If an error made in a tax return results in an overpayment of tax, the organization has the right to:*

- submit an updated declaration for the period in which the error was made (but are not obligated to do so);

- correct the error by recalculating the tax base and the amount of tax for the period in which this error was discovered. This method can be used regardless of whether the period in which the error was made is known or not;

- do not take any measures to correct the error (for example, if the overpayment amount is insignificant).

The tax base of the current period can be adjusted not only when errors are identified in the declarations. You can also take advantage of the provisions of paragraph 3 of paragraph 1 of Article 54 of the Tax Code of the Russian Federation in cases where an overpayment of tax arose due to changes in legislation that have retroactive effect. If such changes improve the situation of the taxpayer, then the organization may find income that previously could not be excluded from the tax base, or expenses that were previously prohibited from being taken into account for tax purposes. It is not necessary to submit updated declarations in such situations. You can recalculate tax liabilities in the current period. This conclusion follows from the letter of the Federal Tax Service of Russia dated June 24, 2014 No. ED-4-15/12067.

Situation: For which taxes can the provisions of Articles 54 and 81 of the Tax Code of the Russian Federation on recalculation of the tax base be applied without submitting updated declarations? In the current period, errors were discovered that were made in previous periods and resulted in overpayment

The possibility of applying the norms of these articles exists only in relation to income tax*, transport tax, mineral extraction tax and the single tax under simplification.

This is explained as follows.

To make changes, use the following algorithm.*

1. In the tabular part of the additional sheet, in the “Total” line, transfer the data in columns 14–19 from the sales book for the quarter in which the invoice was registered before corrections were made to it.

2. On the line following the “Total” line, reflect the data of the invoice that is being cancelled.

3. In the next line, reflect all the necessary details of the invoice with the changes made.

4. In the “Total” line, summarize the total for columns 14–19. To do this, use the formula:

For each correction of sales book data, create a separate additional sheet.

When making several corrections relating to one quarter, reflect the data in columns 14–19 on the “Total” line of the previous additional sheet on the “Total” line of the subsequent sheet. Use the “Total” line data to make corrections to the declaration.

This procedure is provided for in Section IV of Appendix 5 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

An example of making corrections to the sales book for the past tax period*

The organization has a workshop for sewing outerwear (activities are subject to VAT).

On September 29, LLC Trading Company Hermes shipped a batch of outerwear to the Alpha organization (60 down jackets at a price of 5,900 rubles per piece, including VAT). When preparing the invoice, the accountant indicated the amount of RUB 365,800. (including VAT – RUB 55,800). On the same day, the accountant wrote out and issued invoice No. 1659 to the buyer and registered it in the sales book. In the invoice, the Hermes accountant erroneously indicated the cost was not 354,000 rubles. (including VAT - 54,000 rubles), and 365,800 rubles. (including VAT – RUB 55,800).

In October, the Hermes accountant discovered an error and issued a corrected invoice No. 1659 dated September 29, indicating the quantity (60 down jackets) and the amount corresponding to the actual goods shipped (354,000 rubles).

By the time the error was discovered in the original invoice, the VAT return for the third quarter had already been submitted. Therefore, the accountant made corrections to the sales book by filling out an additional sheet of the sales book.

Olga Tsibizova, Deputy Director of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia

Sincerely,

Svetlana Sharipkulova, expert of the BSS "System Glavbukh".

Answer approved by Natalia Kolosova,

Head of the VIP support department of the BSS System Glavbukh.

In this article, we will look at the concept of “reversal” (“red reversal”) in Russian accounting, and how to make a reversal in 1C Accounting 8.3.

Methodological and historical aspects

Storno is a way of adjusting data in accounting (from Italian stornare– withdraw, turn back). The term reverse (reverse) is actively used, which can be called a synonym for the word minus. Incorrectly entered entries* (they entered an extra document, made a mistake with correspondence, indicated an inflated amount) are subject to zeroing, for this purpose such entries are reflected in accounting with a negative sign.

*The term reverse is not always used in case of errors. Sometimes, if during a period accounting is carried out at planned prices, and then they are adjusted to actual prices, it becomes necessary to reduce the amount. In this case, the term “reverse” is also applicable.

Previously, when accounting was kept manually, in the turnover or accounting books, when errors were discovered, the incorrect amount was not crossed out, but was additionally written down in red ink. If red ink was not at hand, then such amounts were written down and circled in a rectangular frame. When calculating the overall totals, the amounts written in red should have been subtracted, or, in professional terms - reverse the amount. It looked something like this:

Example 1: Account turnover, the amount of 1000 is correct, instead of the amount of 4000 they indicated 4400 (Operation 2).

Option 1

Option 2

The color reversal method was first described in 1889 by Alexander Aleksandrovich Beretti, and in Russian accounting a stable phrase has emerged - “red reversal”.

Theoretically, you can reset an erroneous entry by swapping debit and credit, creating a so-called reverse reversal. This approach creates the correct final balance, but the amount of turnover on the accounts will be overestimated, which will lead to some unreliability of the accounting information. By changing our example, you can clearly see this:

Option 3

Sometimes the method of correcting errors by reverse posting is called “black reversal,” although this term cannot be called official. Moreover, there are options for action here too. It is possible, as in option number three (if the accounts are correctly corresponded), to indicate only the delta between the correct and deposited amount and not create additional correct postings (Operation 3).

Option 4

The reverse reversal method is usually used in credit institutions or Western accounting systems. In Russian accounting, by default, reversal is most often understood as “red reversal”. Legislatively, for example, in the accounting law, the term reversal does not appear. The procedure for correcting errors is described in PBU 22/2010, but there is no term for reversal there either. At the same time, in other acts of legislation, mainly related to budgetary or autonomous organizations, the text directly refers to the red reversal method as a method for correcting errors. Based on the practice that has developed in our country of reversing erroneous documents, we will further understand the term “reversal” as “red reversal”.

Automation and reversal

When accounting was transferred to the area of automated processes, that is, when accounting was done on a PC, they began to generate postings with a minus sign (the correspondence of accounts did not change), and in the turnover, for better visualization, they left the red color for negative values. On some reporting forms you may see an instruction to show negative numbers in parentheses. When calculating the totals, we know that we must subtract them.

Note that if, as a result of an error, an underestimated amount was indicated, and the correspondence of accounts is correct, then an option is possible when the reversal method is not applied, but an additional entry is simply created for the difference in the amount.

Let us pay attention to an important nuance that determines the specifics of modern accounting using 1C. When posting a document in the program, transactions are generated in accordance with the chart of accounts. They are called that - accounting entries, which will ultimately show the amounts of assets and liabilities on the balance sheet. But the financial service also needs to fill out tax returns, reports to funds and other registers that are not methodologically tied to the chart of accounts and can be formed according to completely different principles. A stable term “tax accounting” has appeared, data for which should be generated in accordance with the Tax Code (accounting data is generated in accordance with PBU - Accounting Regulations). In 1C, in settings and postings you can often see the abbreviations BU (accounting) and NU (tax accounting). In addition, there are additional intermediate registers. For example, data for the purchase and sales ledger is generated in similar registers. Therefore, the reversal of documents should affect not only transactions related to accounting and tax accounting - the registers must also be filled out correctly.

Creating reversal documents in 1C 8.3

Let's look at reversing documents in 1C using the example of a vacation accrual situation.

Example 2: In November 2017, an employee was accrued vacation pay in the amount of 30,000, but should have indicated the amount of 25,000. The reversal operation in 1C 8.3 will be in December 2017.

Transactions => Transactions entered manually

Figure 1 Menu path

Button Create displays a list of allowed actions, select Reversal of the document.

Figure 2 Creating a Reversal document

Figure 2 Creating a Reversal document

Then you must specify the document to be reversed.

Figure 3 Filling out the reversal document

Figure 3 Filling out the reversal document

First, select the document type, then the document itself.

Figure 4 Selecting a document type

Reversal postings are generated automatically.

Figure 5 Reversal transactions generated

Please note that in addition to accounting and tax accounting data, other accounting registers are filled out.

Figure 6 Filling data registers

If suddenly some accounting register is not automatically included in the reversal document, you can add it manually. To do this, in the menu buttons More need to press Register selection... and select the appropriate one from the list.

Figure 7 Register filling service

Printed form of the document Reversal – accounting certificate.

Figure 8 Accounting statement for the reversal document

It should be noted that the technical side of reversal of release in 1C was shown here. In practice, it is often impossible to simply reduce and recover from an employee amounts already paid, since it is necessary to take into account the provisions of Art. 137 labor code.

Reversal of implementation in 1C

For documents from the section Implementation reversal in 1C is performed according to the above algorithm. Reversing the sales of the previous period will generate accounting entries automatically and correctly, but reversing VAT in tax accounting will require additional settings.

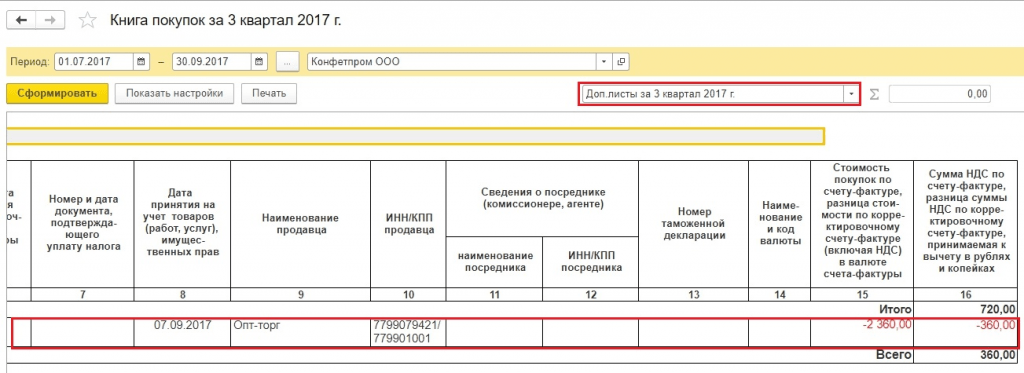

Example 3: in September 2017, an act and invoice were issued for services rendered in the amount of 11,800 rubles, incl. VAT 1,800 rub. The accountant processed these documents. The counterparty did not sign the work completion certificate in September, and agreed to do so only in November 2017. The September document should be reversed.

To correctly account for VAT, along with reversing the document in accounting, you should fill out an additional sheet to the sales book for the 3rd quarter of 2017. In this additional sheet, the erroneous invoice will be cancelled. Please note that the VAT adjustment document itself will be created in November 2017, but it will indicate the adjustment period - the 3rd quarter of 2017. Based on the adjusted data, it will be possible to fill out an updated VAT return, in which Section 9 will appear.

In the implementation reversal document, go to the tab VAT Sales.

Figure 9 VAT Register Sales

Figure 9 VAT Register Sales

We fill in the columns related to the additional sheet of the sales book. In the adjusted period column, enter the date from the third quarter.

Figure 10 VAT register adjustment

Figure 10 VAT register adjustment

In the Sales Book report, set the settings.

Figure 11 Sales Book report settings

Figure 11 Sales Book report settings

Additional sheets have appeared in the sales book.

Figure 12 Formation of new sections in the sales book

Figure 12 Formation of new sections in the sales book

An invoice has been reversed.

Figure 13 Additional sheet in the sales book

Figure 13 Additional sheet in the sales book

We fill out an updated VAT return. Be sure to indicate the correction number.

Figure 14 Updated VAT return

Figure 14 Updated VAT return

We fill out the declaration, we see the data in section 9.

Figure 15 VAT return, section 9

Figure 15 VAT return, section 9

Reversal of receipts in 1C 8.3

Example 4: the supplier's invoice was mistakenly posted twice - once in the advance report, the second as a goods receipt document. One of these receipts must be deleted. We will reverse the amounts under the second document.

Figure 16 Documents in the 1C program

Figure 16 Documents in the 1C program

The reversal of receipts in 1C 8.3 is formed according to the algorithm already discussed. In accounting, the amounts were reversed; in tax accounting for VAT, the situation is more complicated. Missing register VAT Purchases.

Figure 17 Reversal of document Receipt

Figure 17 Reversal of document Receipt

The invoice document, the primary one - not reversed, contains data that influences the formation of additional sheets of the purchase ledger.

Figure 18 VAT Register Purchases on invoice

Figure 18 VAT Register Purchases on invoice

There are several options for filling out the register VAT Purchases. You can click on the button More add this register to the document (reversal Receipt) and fill it in manually.

Figure 19 Option for adding a VAT register

Figure 19 Option for adding a VAT register

Figure 20 Selecting a VAT register Purchases

This register can also be filled in automatically when reversing an invoice.

Figure 21 Filling in data to generate an additional sheet

Figure 21 Filling in data to generate an additional sheet

If the VAT register is filled out correctly, an additional sheet will appear when creating the purchase ledger.

Figure 22 Section with additional sheets in the purchase book

Figure 22 Section with additional sheets in the purchase book

When filling out the declaration, the data will be in section 8.

Figure 23 Updated VAT return, section 8

Figure 23 Updated VAT return, section 8

There are a couple more ways you can fill out additional sheets in the purchase book.

Method 1

Operations => Reflection of VAT for deduction

Figure 24 Menu path

Figure 24 Menu path

We indicate in the settings of this document that we are creating additional sheets and purchase book entries

Figure 25 Settings in the document

Figure 25 Settings in the document

On the tab Goods and services Click the Fill button to select an option Fill in according to the settlement document.

Figure 26 Selecting a filling option

Figure 26 Selecting a filling option

When filling out this section, by default the amounts are indicated as positive. We need to cancel the invoice, so we manually change the value Sum to negative, graphs VAT And Total will be recalculated automatically.

Figure 27 Generating document data

Figure 27 Generating document data

Method 2

Operations => Regular VAT operations

Figure 28 Menu path

Figure 28 Menu path

Then Create => VAT recovery

Figure 29 Selecting a document type

We indicate that the restoration must be reflected in the purchase ledger. A warning appears, click Yes.

Figure 30 Formation of a document

You can fill in the data manually using the button Add. By button Fill select an option Fill in the amounts to be restored. In this case, there is no need to change the amounts to negative values.

Figure 31 Selecting an option to fill out a document